11

Books and arts - Imagining nuclear war

The terrifying thing about “The 2020 Commission Report” is how much of it is real

8

Books and arts - Egypt after the revolution

David Kirkpatrick chronicles the tumult in Egypt and America’s myopic response

6

19

Finance and economics - Buttonwood

Why the largest group of American corporate bonds is a notch above junk

7

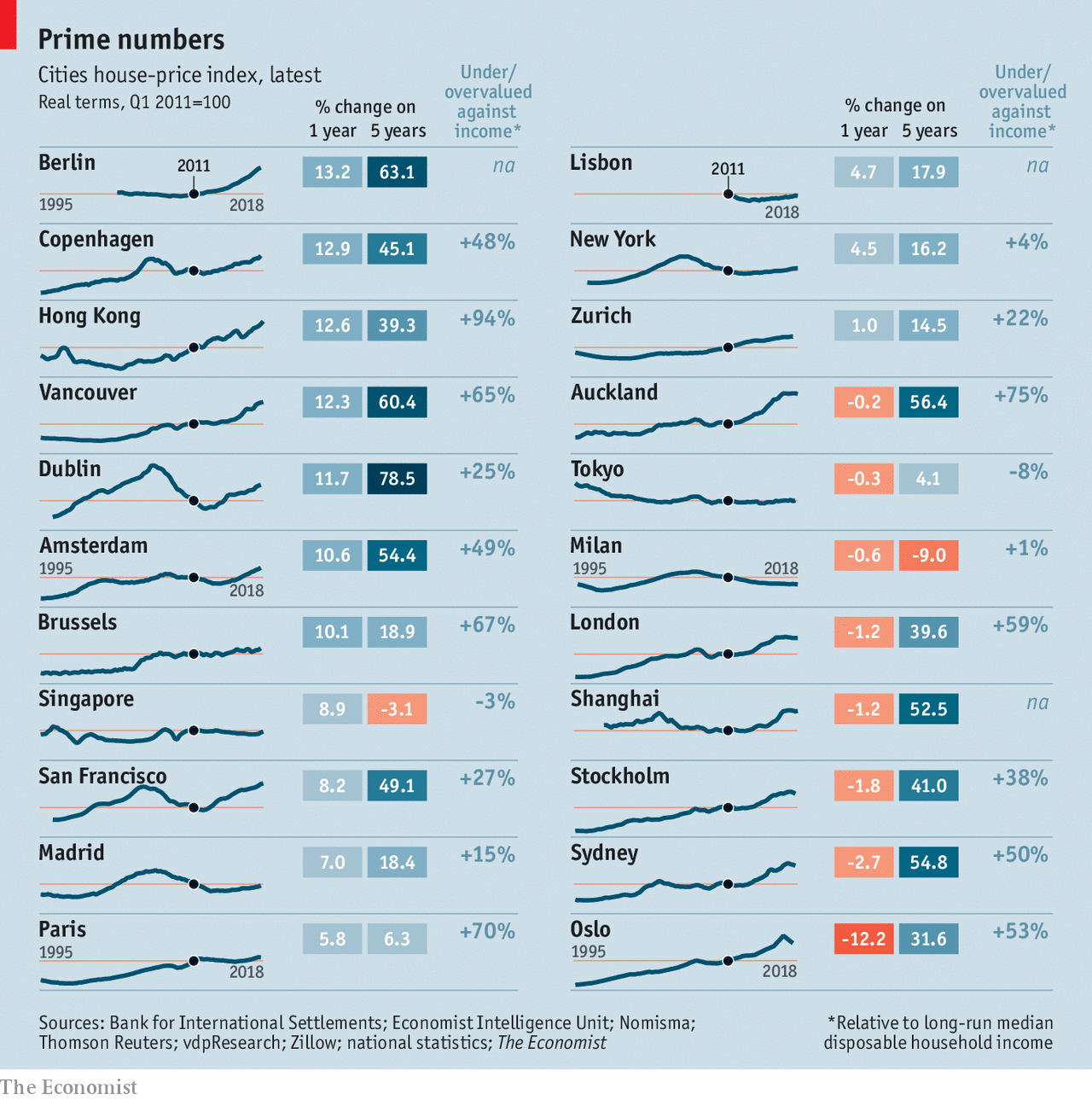

Finance and economics - Property prices

After years of strong growth, property prices are on the turn

13

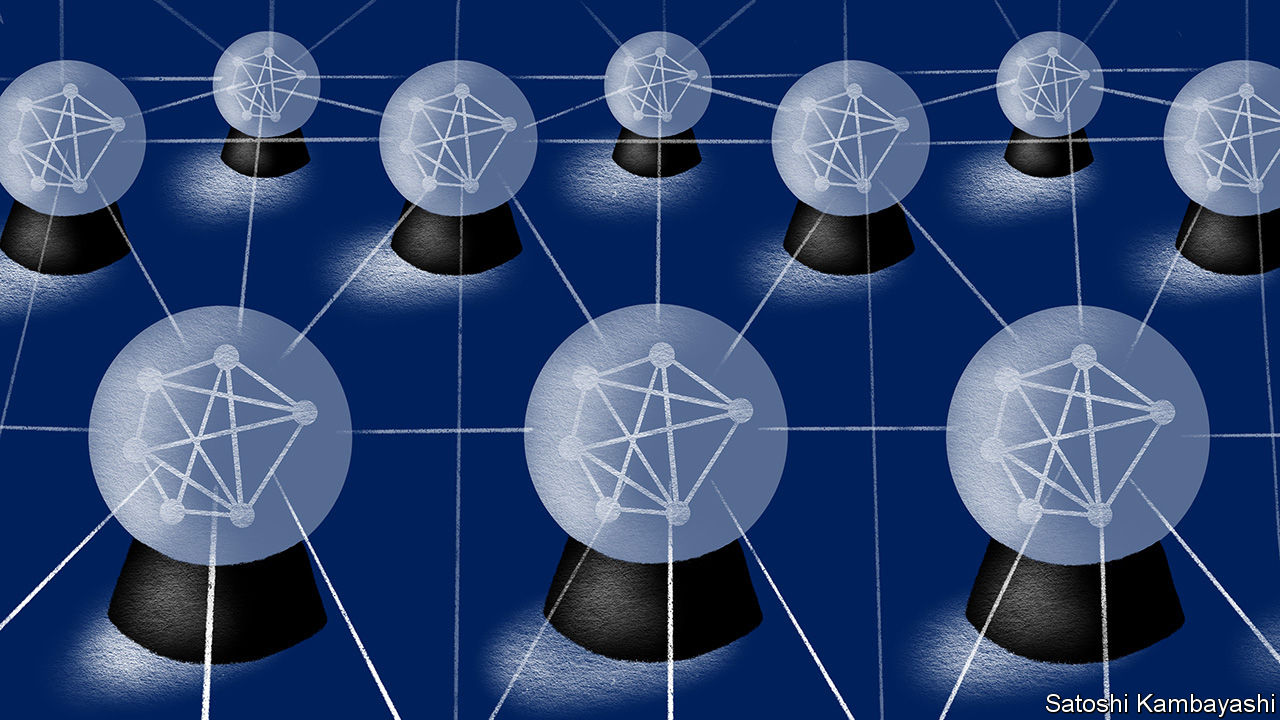

Finance and economics - Prediction markets

Blockchains could breathe new life into prediction markets

5

Finance and economics - Fund management

A data boom enables an algorithmic approach to fixed-interest investing

16

8