Ad-renaline rush. Amazon’s ambitious drive into digital-advertising

Building a big ad business will help the firm to keep expanding

199

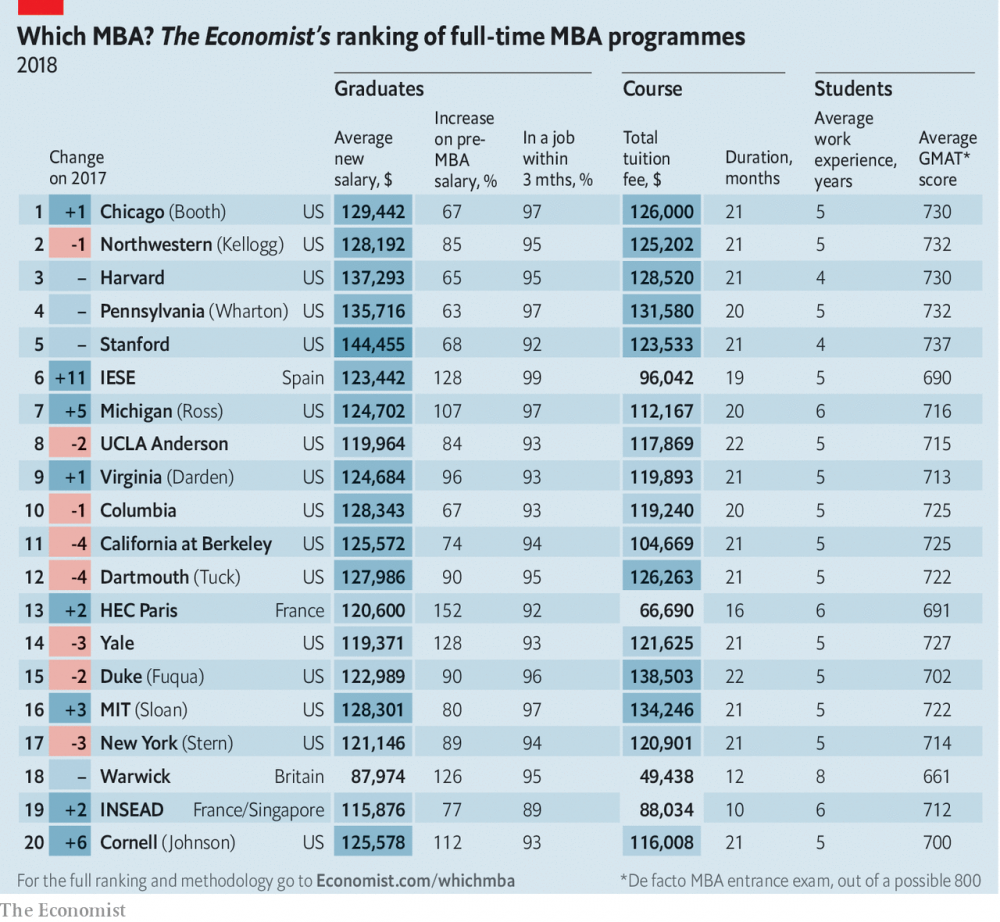

Which MBA? The world’s best MBA programmes

The Economist’s ranking of the world's leading business courses

212

Virtuous spirals. DNA may soon be used to store computer data

But it is not just a question of base pairs becoming bits

147

The next recession

Toxic politics and constrained central banks could make the next downturn hard to escape

209

Generation gap. Established firms try dancing to a millennial tune

Some are finding it surprisingly easy

126

Workers on tap. How governments should deal with the rise of the gig economy

Watch it by all means, but welcome it

112

Sex and power. #MeToo, one year on

A movement sparked by an alleged rapist could be the most powerful force for equality since women’s suffrage

171

Migration after Brexit. How to bend the EU’s rules on free movement

Many countries interpret the principle rather more loosely than Britain

51

Not so fast. What to do about Africa’s dangerous baby boom

African countries do not need to resort to Asian-style illiberalism

167

AI, EU, go. How Europe can improve the development of AI

Its real clout comes from its power to set standards

156