Bitcoin hovers around 96k. Could ETH play catch-up in December? XRP outperforms

Bitcoin ended last week at approximately the same level that it started, around 96,000. There was some choppiness and volatility, with the price rising to a record high of 98.9k before dropping to 91k on Tuesday and then steadily grinding higher back towards 96k. The world’s largest cryptocurrency is starting the new week just below this level at 95.3k but keeps the key 100k milestone in focus.

Gold Price Forecast: XAU/USD needs a weekly close above 21 DMA to confirm a bullish reversal

Gold price is making a tepid recovery attempt near $1,870 early Friday, reverting toward a fresh two-week high of $1,885 set on Thursday. Gold price has resumed the upside, as the United States Dollar (USD) buyers take a breather amid retreating US Treasury bond yields.

Five Key Charts to Watch in Global Commodity Markets This Week

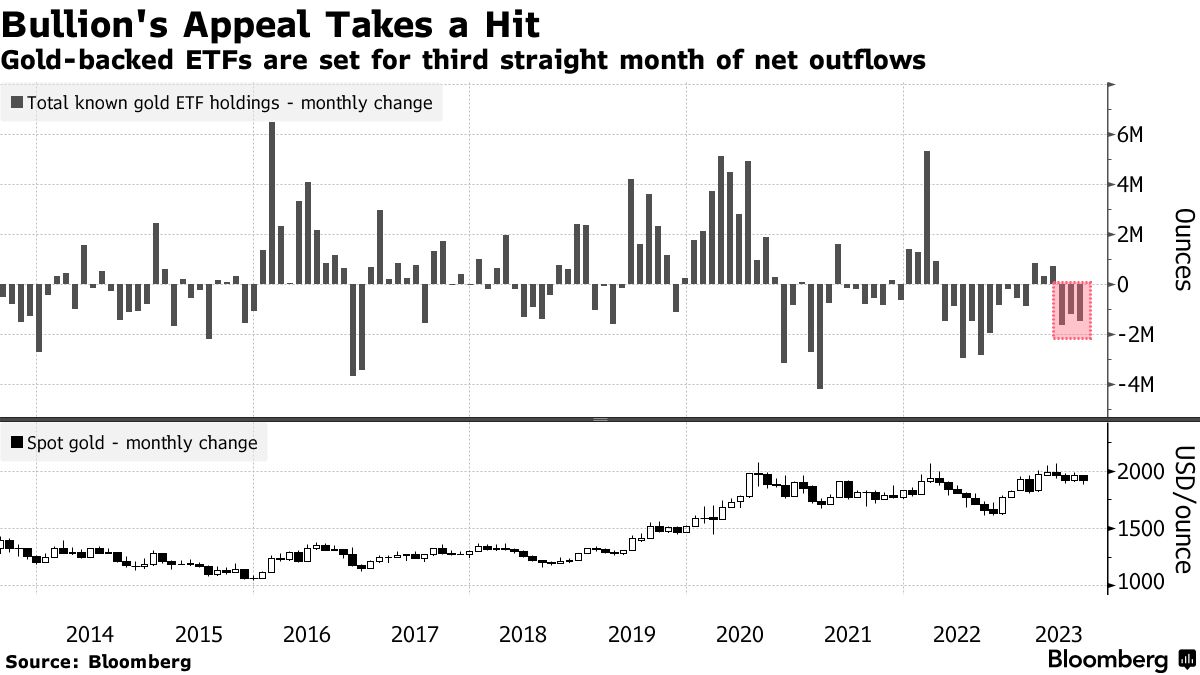

Spot gold reversed a four-week slide last week, but the rally may not last. Meanwhile, global subsidies for fossil fuels have never been higher even as the climate crisis wreaks havoc around the world.

Crypto world news

- The Tornado Cash mixer has been officially blacklisted in the US - American individuals and legal entities are prohibited from interacting with the mixer and any addresses associated with the project. The sanctions included 38 Ethereum addresses and 6 USDC addresses associated with Tornado Cash. — The Ethereum rate has reached the level of $1800. — The number of installed cryptomats in the world has exceeded 39,000. Now cryptomats are installed in 77 countries, they are served by 614 operators. Singapore-based crypto lending platform Hodlnaut has announced a withdrawal ban due to deteriorating market conditions. Cryptocurrency miner Marathon Digital recorded a net loss of about $192 million in the second quarter Daily Review...

Oil Sellers Set to Test $90 Support

On Thursday, August 4, according to the results of the day, a barrel of Brent fell in price by 3.91%, to $93.32. The decline in quotes is more caused by a technical factor than a fundamental one. The fall in prices accelerated after buyers surrendered the $100 per barrel level. Key support is at $90. If the fall slows down near the support, then with a high probability we should expect a rebound from it. If buyers begin to actively close long positions in the futures market, the next support will be the level of $86. On Friday, August 5, at auction in Asia, Brent crude is traded at $94.38 (+1.14%). The focus of attention of traders is directed to the report on the US labor market for July. The data is important to the US Federal...

Crypto Update

— Crypto market capitalization: $1.060 trillion (+$9 billion); — Dominance: BTC - 41.2%, ETH - 18.6%; - Index of fear and greed: 34 (extreme fear) against 31 the day before. Bitcoin: on Tuesday, August 2, at the end of the day, Bitcoin fell by 1.20%, to $22,987. The price closes lower for the sixth day in a row. The fall was small and amounted to 3.59%. Yesterday, the focus of all market participants was the visit of US House Speaker Nancy Pelosi to Taiwan. Tensions between China and the United States have risen after Chinese President Xi Jinping threatened an armed response if Pelosi arrived, concentrating troops near Taiwan. The rise in geopolitical risks has reduced risk appetite. Since the cryptocurrency and stock markets are...

Oil Holds Above 100 Awaiting OPEC Decision

On Tuesday, August 2, at the end of the day, a barrel of Brent fell by 0.44% to $99.71. The price was trading in the range of $98.50 - $102.50 per barrel. Market participants are waiting for the decision of OPEC +. Today, OPEC+ will hold a meeting on quotas for September. At 14:00 Moscow time, the members of the OPEC ministerial committee will meet and, based on an analysis of the oil market, make a recommendation on quotas. At 14:30 Moscow time, a video conference of the heads of alliance delegations will begin, at which oil production quotas may be maintained or slightly increased. In August, the increase was 648 thousand barrels per day. At the same time, many countries remain on schedule to increase production. On Wednesday...

Oil: buyers ready to pass $107 resistance

On Monday, July 25, oil trading ended with growth. A barrel of Brent has risen in price by 1.19%, up to $104.81. The price is trading in a limited range as expectations of a global recession are on one side of the scale, and a reduction in Russian oil exports due to Western sanctions is on the other. Now the attention of investors is riveted to the meeting of the US Federal Reserve, as a result of which the US Central Bank may significantly raise interest rates by 100 bp. A serious tightening of monetary policy by the Fed, according to many experts, could lead to a recession in the US economy. At the press conference, J. Powell will tell us about the future steps of the Fed, which will become the basis for the pricing of commodity...