What is market psychology?

Trading psychology is the ability of traders to understand their emotions and manage them. But the market is a reflection of the emotions of all its participants. Therefore, when trading on the stock exchange, it is necessary to take into account several psychological factors:

How to trade using the BB1 strategy (Bollinger Bands with a deviation of 1) on Olymp Trade

Bollinger bands are one of the technical analysis tools used by traders to make it easier to read the market. It can be applied in many ways, and today I will show you a strategy based on Bollinger Bands with a deviation of one.

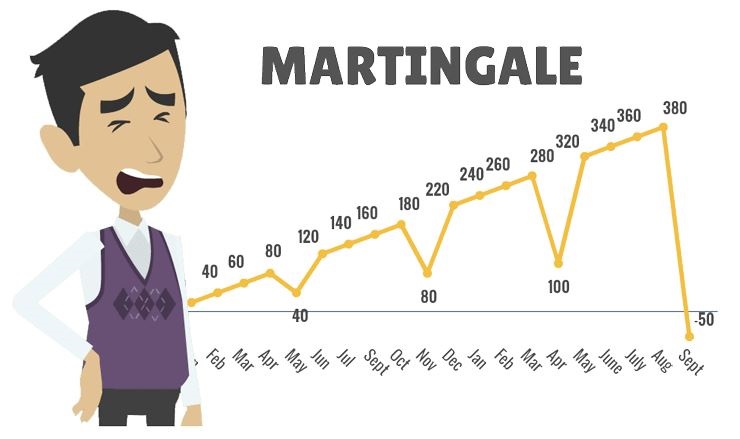

Martin Strategy Olymp Trade

Initially, the technique was called Martingale. This is a fairly common trading system, both on binary options and on the Forex market. With its help, it is recommended to trade only experienced traders who have a large enough initial deposit. Despite the fact that OlympTrade makes it possible to trade from only $ 1 and with a minimum balance, the system will not always be profitable.

Binary Gambit Strategy Olymp Trade

This system is based on the analysis of the economic calendar. In order to start working on this technique, open the economic calendar and see all the most important news for the near future. It is better to pay attention to the events concerning the US dollar. The news release will affect all currency pairs with the dollar.

Scalping Trading Strategy

A simple strategy that allows even a beginner to earn money! You can open a deal almost always, and the risk of losing funds is minimal, if not negligible!

Olymp Trade Working Trading Strategies (1)

Statuses on Olymp Trade are used to define account levels attained by progressing through Trader’s Way. The more an Olymp Trade user trades on the platform, the higher their status, and the more trading privileges and tools are provided. Olymp Trade has three statuses: Starter, Advanced and Expert. Learn more about statuses here.

کسب پول اینترنتی!

اگر به تجارت علاقه دارید اما نمی خواهید برای آموزش و پرورش هزینه ای بپردازید، پس این مقاله برای شما مناسب است.